Tired of waiting days for invoice payments to settle?

Crezco is the open banking payment solution designed for online invoices.

Via their single or recurring payment solution, they can eliminate card fees and slow settlement times, saving you money, time spent reconciliating, and improving your cash flow.

Why accept open banking payments with Crezco?

1

get paid faster

Payments settle in seconds, not days. Companies who accept online payments reduce their debtor days by 27%.

2

free to use

Using the UK's Faster Payments system, we eliminate cards fees and chargebacks for domestic payments up to £1,000,000. For every 25 invoices our clients on average save £1,000 on fees.

3

auto-reconciliation

Integrates with popular accounting platforms like Xero and Quickbooks, saving you time and effort reconciling paid invoices.

4

invoice fraud protection

Crezco's advanced fraud protection system protects your business from money laundering and payment fraud.

5

multiple entity management

Managing various businesses or clients, then add multiple entities via a single account.

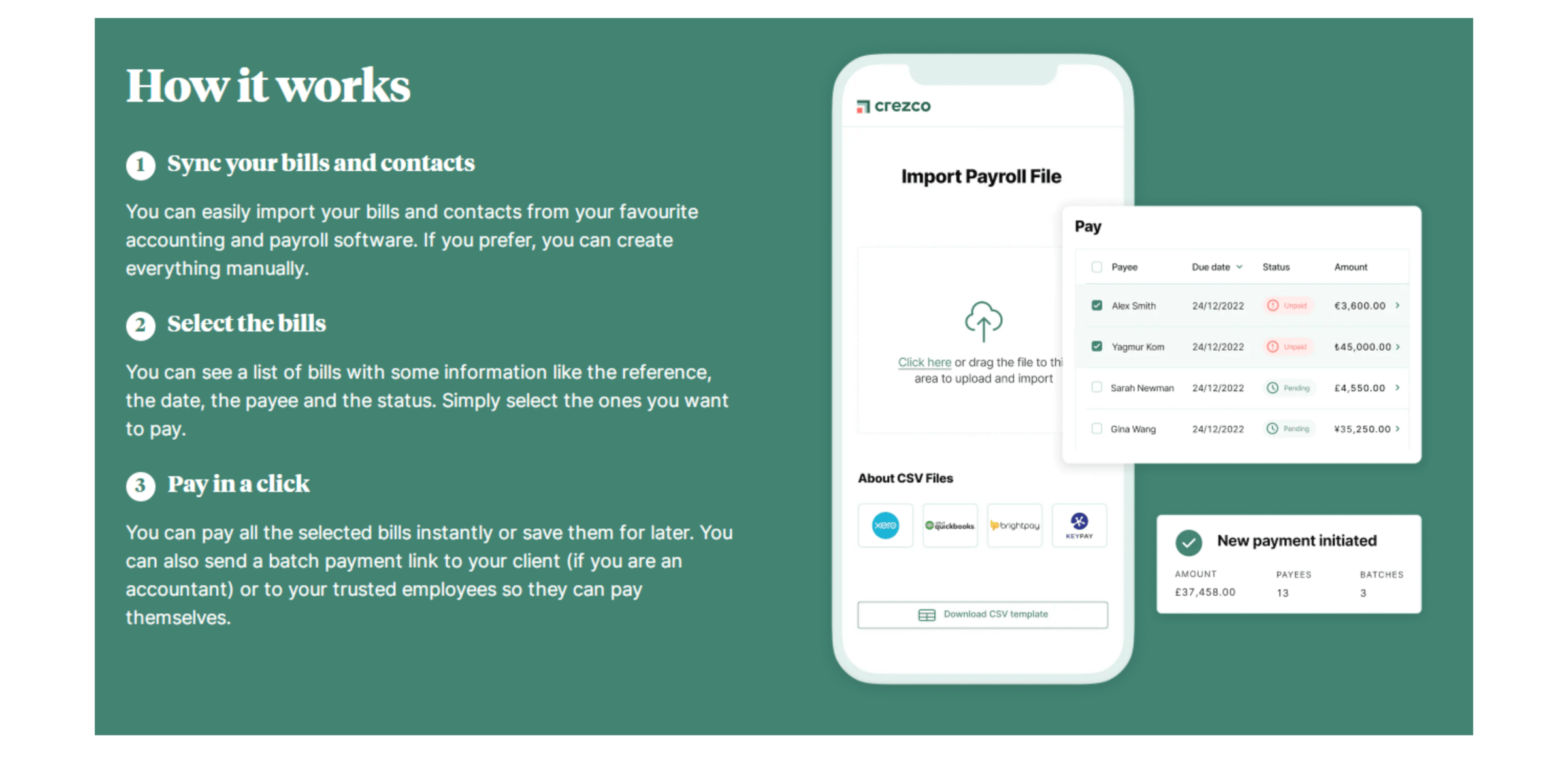

Want to make instant bulk payments?

Crezco's bulk payment product allows you to securely pay suppliers and staff all around the world from a single bank authentication. They are constantly innovating at Crezco and now you can leverage our open banking payments for account payables as well.

What makes bulk payments with Crezco different?

1

single payment initiation

Users create a batch payment and initiate payments with a single authentication. All payments show as individual lines within bank statements.

2

easy import

Crezco recognises CSV files from the most popular accounting and payroll software's but also lets you manually import files if needed.

3

sharing and permissions

Allow staff to create batch payments and share with management for approval and payment initiation.

4

international payments

Crezco settles payments in multiple currencies so you can pay suppliers and staff all around the world while only needing to authenticate with your bank for a single batch payment.

5

easy to use

Get set up in seconds, select your payees in a couple of clicks and initiate your payments with a single bank authentication.

Want to make international payments to suppliers?

The first account-to account payments solution to handle cross-border payments, as well as domestic payments. They keep innovating at Crezco and have designed the ultimate cross-border solution to be easy-to-use, secure and cost effective.

What makes international payments with Crezco different?

1

cost

Their domestic payments (GBR and EUR) are free and cross-border payments provide the most competitive rates for business. There are no hidden bank fees here.

2

speed

Crezco strives to send money faster everywhere. They believe they have the quickest solution available, but are always looking to improve.

3

security

Crezco's award-winning proprietary risk tools (Sentinel) and the use of open banking assures payments arrive where they should with no room for human error.

4

convenience

Integrating account-to-account technology with advanced cross-border solution provides the ultimate convenience requiring minimal human effort.

5

visibility

Crezco provides both parties with live updates from when the funds leave the payer's account to when they arrive with the payee.

Wigan Office

41 Bridgeman Terrace

Wigan

WN1 1TT

Tel: 01942 760500

Bolton Office

365 Tonge Moor Road

Bolton

BL2 2JR

Tel: 01204 364652